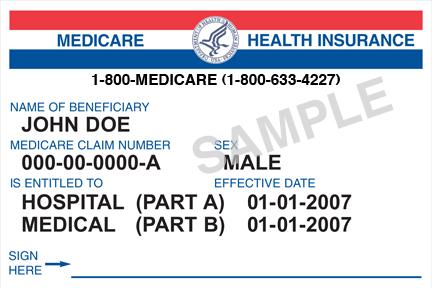

Do I Really Need a Medicare Supplement?

David Belk, a doctor and anti-supplement activist says, “…If you have Medicare and buy a supplemental policy with your own money, you are effectively giving an insurance company your money so that they can keep it.”

Wow. This statement is moving. For those who have had a Medicare Supplement Policy for years, it slaps you in the face with regret.

And for those who may not be on Medicare and have yet to purchase Medicare Supplement Insurance, it frees you. It justifies a decision that will save you money on premium month to month.

However, it is not entirely true. He has a point, but—ultimately—it represents a fundamental misunderstanding of what insurance is.

If you take this statement at face value, it would imply that virtually all insurance is worthless.

Here’s why: in the vast majority of cases, people pay into insurance and then rarely use it. This is what keeps insurance companies in the black.

How many people spend thousands over years on homeowner’s insurance and never have their house burn down? How many people purchase car insurance and only experience a couple of fender benders over their lifetime? Are they essentially “giving their money away to an insurance company”? Yes, you could say that, and it wouldn’t be inaccurate, just a bit misleading.

Because you don’t buy insurance for things you expect! Rather, you buy it for things with a high dollar amount of risk and a low probability of happening!

You can’t insure what is high risk and high probability. Take Alex Honnold, for example. He spends his waking hours climbing steep ravines with no safety harness. For hours a day, he is one missed footing away from plummeting to his doom. Do you think he is going to be able to get life insurance? It’s almost laughable. This is a high risk, high probability scenario. Of course no insurance company will take a chance on him!

You can insure against a low risk, low probability scenario, but why would you want to? Do you want pet insurance for your grandson’s gerbil? Obviously not. Even a low-premium insurance plan wouldn’t be worth it. What did you pay for it? 30 bucks? Maybe fifty if it’s some hypoallergenic, exotic breed? Either way, it’s not a high enough risk.

So this begs the question…what does a supplement cover? Is it something that is low probability and high risk?

Well…there are varying coverage levels, but even the lowest premium plans cover Medicare’s scariest coverage gap: the unlimited out-of-pocket spending limit.

Sure, a lot of them cover “nickel and dime” copays and coinsurance costs that virtually eliminate hassle and reduce costs, but this is just icing on the cake. The real substance of a Supplement Plan is that it puts a cap on your potential out-of-pocket spending.

With Medicare alone, there is absolutely no limit to what you can spend.

One of our clients had triple bypass surgery and ended up with a $7,000 bill. My father-in-law with lung cancer had approximately $30-40,000 in charges for outpatient chemotherapy and radiation. I ran into a man who—after a few years of extended illness—racked up over $140,000 in bills that Medicare alone didn’t cover.

Can you imagine the devastation if any of these retirees forfeited Medicare Supplement Insurance? If these individuals had chosen Medicare alone, those outrageous bills would’ve been heaped upon their shoulders.

Now, what are the chances of this happening to you?

Not very high.

But that is the point! What are the chances that your house is going to burn down? What are the chances that your car will get totaled? You can cite statistics like Dr. Belk and say, “Look…not very many people need this insurance.” However, this doesn’t make those isolated cases any less scary. And it doesn’t change the fact that, from 2006-2015, Medicare Supplement Insurance companies consistently paid out over 75% in claims what they gathered in premiums. Insurance is not about whether or not you are going to get out what you pay in; it is about peace of mind.

So yes…I do recommend buying Medicare Supplement Insurance. You don’t necessarily need an expensive, luxury plan, but having something in place is essential. Even if you can’t afford a Supplement, you can (at the very least), purchase a low or no cost Medicare Advantage Plan that will cap your annual out-of-pocket spending at $4-6,000.

This won’t guarantee that you won’t be “giving an insurance company your money” but it will guarantee that you can live your retirement life freely and fearlessly, knowing that—in all those unlikely but possible scenarios—

you’re still covered.

Wondering how much a Medicare Supplement will cost you? Click here to use our Medicare Supplement quoting tool to find out!